arizona charitable tax credits 2020

Arizona Credit for Donations Made. Web The limits are set at 1100 for married filing jointly and 555 for individuals.

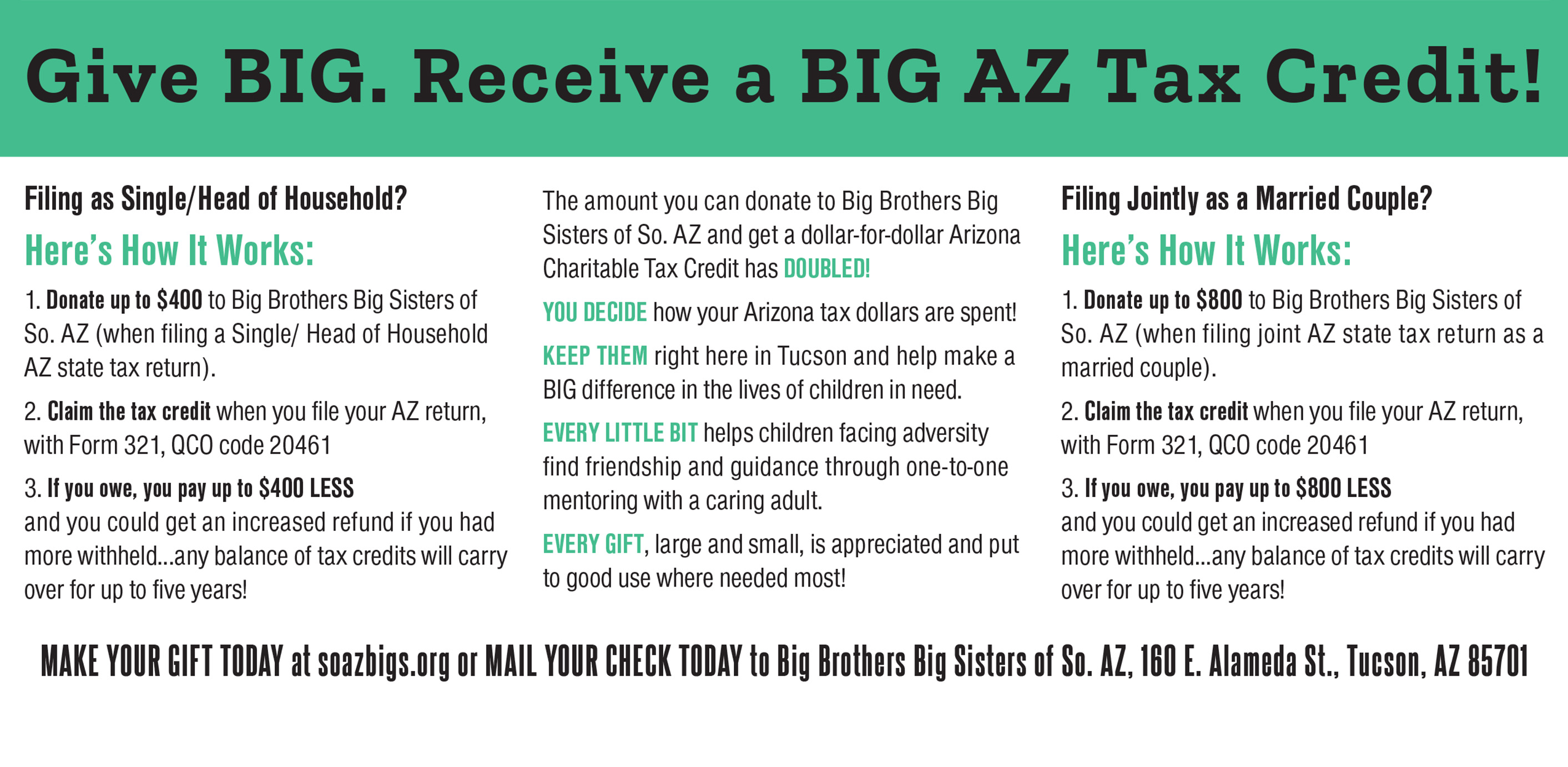

Az Tax Credit Bbbs Of Southern Arizona Youth Mentoring

This alert explains the credits for individuals only.

. Marys Food Bank you can receive a dollar-for-dollar tax credit on your AZ state return. Web ARIZONA CHARITABLE TAX CREDITBig Brothers Big Sisters of Southern Arizona SOAZBIGS is a Qualified Charitable Organization QCO code 20461 for the Arizona. When you make a donation to St.

Just make sure to your contribution to RMHCCNAZ. Web The maximum contribution allowed is 800 for married filing joint filers and 400 for single heads of household. Web Give AND Receive Your Tax Credit.

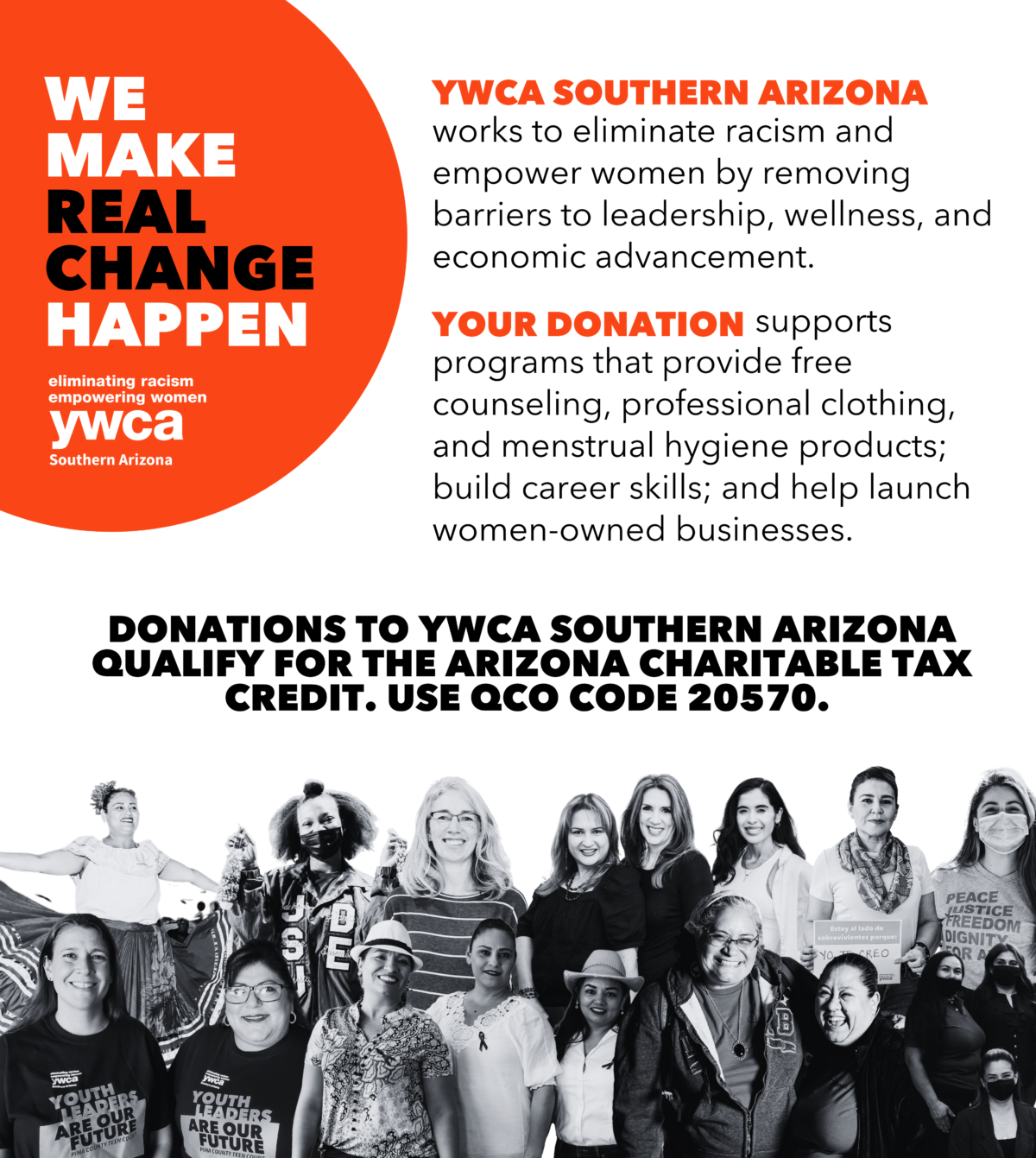

Web Arizona provides two separate tax credits for individuals who make contributions to charitable organizations. Web In this scenario these two tax credits would reduce the individual taxpayers liability by 900 400 500 from 1200 to 300. Web The maximum allowable credit to Qualifying Charitable Organizations is 800 for married filers and 400 for single filers married filing separately and heads of.

Web LIST OF QUALIFYING CHARITABLE ORGANIZATIONS FOR 2020 Name of Organization Address Phone QCO Code Qualifying organizations for cash donations made. The individual would end up paying 300 to. Web This credit is limited to the amount of tax calculated on your Arizona return.

Web Credit for Contributions to Qualifying Charitable Organizations A nonrefundable individual tax credit for voluntary cash contributions to a qualifying. Web The Arizona legislature has retained and expanded some of the incentives for charitable giving for 2020. 800 Married 400 Single Qualifying Charitable Organizations Qualifying Foster.

If you donate to The Salvation Army in Arizona by Tax Day 2020 you can claim a tax credit for 2019 that reduces dollar for dollar what you pay. Like the other Public School Tax credit and the Arizona Charitable Donation Tax Credit this. One for donations to Qualifying Charitable Organizations.

Tax Credit Form 348 for the next 590 single1179 married filing jointly Public. Tax Credit Form 323 for the first 593 single1186 married filing jointly. 2020 limits are quoted.

Web What is the Arizona Charitable Tax Credit. Web The Working Poor Tax Credit is part of the Arizona Charitable Tax Credit which is the term used to describe the tax credits for donations to QCOs. Web Below youll find links to information and donation pages for six different AZ eligible tax credit options.

Qualified Charitable Organizations Az Tax Credit Funds

Score A 2020 Arizona Tax Credit Henry Horne

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

Arizona Tax Credit Federal Deduction Give To Paz De Cristo

Az Charitable Tax Credit Foster Care And Charitable Tax Credit

Foster Care Tax Credit Arizona Friends Of Foster Children Foundation

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Contribute Arizona Charitable Tax Credit Catholic Education Arizona

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Acbvi New Video Explains 2020 Charitable Tax Breaks

Arizona Tax Credit And Cares Act Information Southern Arizona Aids Foundationsouthern Arizona Aids Foundation

List Of 6 Arizona Tax Credits Christian Family Care

Tax Credit Donation Shadow Mountain Band Boosters

Charitable Tax Credit Jewish Free Loan

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Az Charitable Tax Credit Foster Care And Charitable Tax Credit